A payment and collections solution that allows BancoEstado’s customers to view and pay their accounts or services in real time, using the payment methods provided by the bank.

BancoEstado

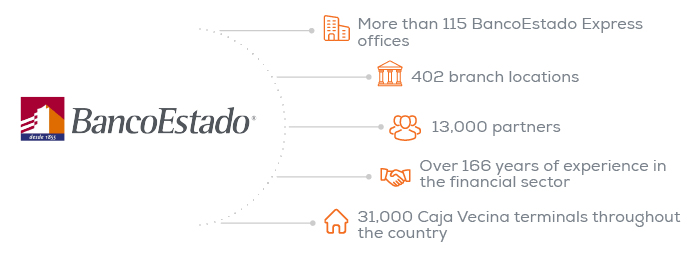

This company has positioned itself as an institution of excellence, with a commercial management of high social impact. Its most recent milestones include surpassing 13 million CuentaRUT accounts and extending the BancoEstado Express and Caja Vecina services throughout all the country’s municipalities.

Evertec

Leading payment technology company in Latin America and the Caribbean that provides a wide range of merchant transaction acquiring, issuer processing, payment digitization, and fraud prevention and monitoring services.

the challenge

BancoEstado is the only public bank in Chile, focused on promoting the development of national economic activities by providing banking and financial services throughout the country. In addition, given its public nature, one of BancoEstado’s main functions has been the development of financial activities in various production and business sectors, which has driven its constant search for strategic partners to help connect its solutions and provide an optimal service to its customers.

This is how it initiated its relationship with Evertec in 2008, which offered the bank a solution to improve its collections service by integrating online payment capabilities, automating operational processes, and drastically reducing manual tasks. The challenge for this solution was to provide the bank with the technical capability to offer online payment capabilities service enabling the accounts of hundreds of companies that need to collect through different service channels. This done with a specialized and exclusive team reducing implementation times and costs for each new service offered.

Evertec offered a multichannel collections solution through a Service HUB, which —in combination with BancoEstado’s multichannel approach— helped integrate various merchants and bank customers who needed an efficient, real-time collections solution for the payment of accounts or services. And all of this provided through BancoEstado’s various channels offering a variety of payment methods.

summary of evertec’s collections service:

- The service integrates the full payment cycle, from the moment the merchant conveys the debt information and is notified of the payment, to the settlement and accounting of the payments made.

- It offers an authorization system that allows for the rapid growth in the number of companies linked to the service, offering ample flexibility in their integration methods adapting to their systems.

- It also provides configuration tools that allow users to modify the operating specifications under each agreement.

- The service integrates bank collection channels like Caja Vecina, BancoEstado Express teller machines, the Web Portals and a Mobile Application for Individuals and Businesses, and any other channels the Bank decides to include in the future.

The partnership has been extended for 5 years

Due to its quality of service and ongoing commitment, BancoEstado has renewed its contract with Evertec.

results

The result of this collection process was an increase in new businesses and linked customers. This led to an exponential growth in transaction volumes, which now exceed 7 million collection transactions per month. Some of the most important benefits obtained were an improvement in customer experience and in the response times of the implementation process for each service, a service that can be adapted to each customer’s needs while being able to maintain the essence of the collections process.