Do you want to transform your business?

Explore our solutionsWe combine security and scalability with a comprehensive portfolio of solutions to transform businesses of all sizes.

Countries using our technology

Across Latin America

See success stories showing how our technology empowers our clients.

The financial sector is experiencing one of the most profound transformations of the past decades, and in Brazil, this shift reached a new milestone on November 13, 2025, when we held the Brazilian edition of Innov8 Experience — an event that consolidates the transition from Sinqia to Evertec and reinforces our vision for the future […]

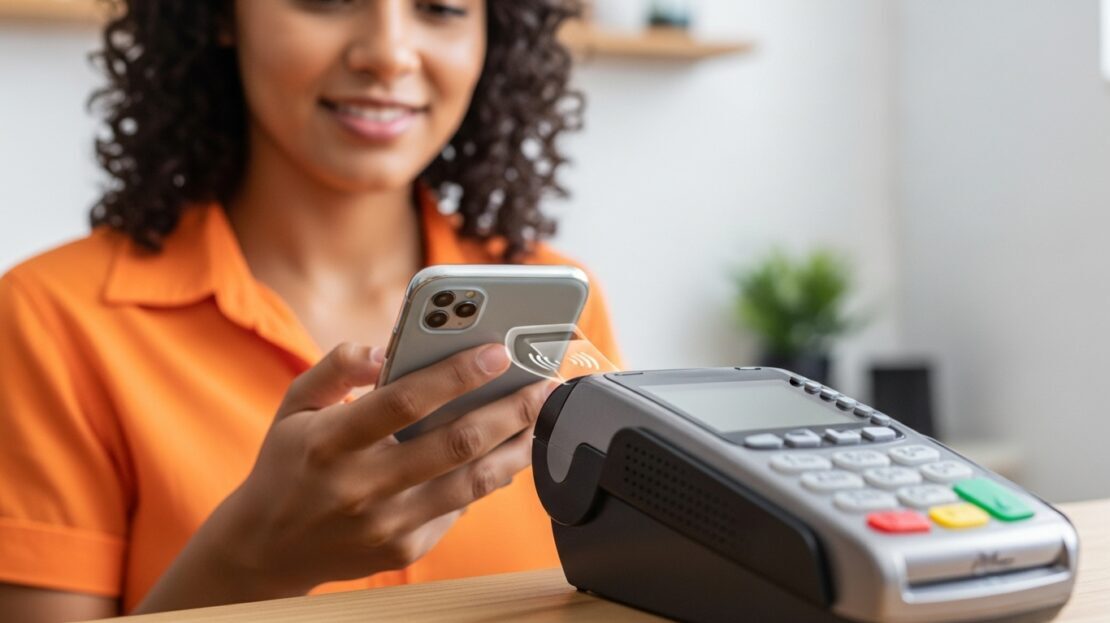

Evertec, a leader in payment technology and financial infrastructure in Latin America and the Caribbean, was recognized with the “Acceptance – Innovative Excellence” award at the Mastercard Engage LAC Excellence Awards, thanks to its innovative implementation of Click to Pay, a solution that is raising the standard of the digital payment experience in the region. […]

In recent months, there has been a concerning increase in fraud schemes exploiting the refund functionality on point-of-sale (POS) terminals. These tactics can severely impact merchants’ financial security and customer trust. How do these frauds work? Fraudsters use several techniques to manipulate payment terminals and issue unauthorized refunds: How to prevent becoming a target? What […]

Pix has transformed the consumer experience in Brazil, making payments faster, more accessible and more inclusive. Its massive adoption has raised customer expectations and redefined convenience standards both in retail and digital environments. Now, the challenge lies in ensuring security, fluidity and digital education to sustain this evolution.

Paytechs and artificial intelligence are reshaping how we pay, save, and invest. This article explores how these technologies are improving financial experiences, driving digital inclusion, and shaping the future of smart payments.

The digital payments ecosystem is rapidly evolving toward faster, safer, and smarter experiences. In 2026, AI, biometrics, digital wallets, and global interoperability will redefine how consumers pay and how businesses adapt to a more agile and personalized financial landscape.

Please share your location to continue.

Check our help guide for more info.